Contents

Forex brokers help facilitate the buy and sell positions of forex traders, ensuring trades can be opened immediately, and positions can be closed when the trader wishes. If you are an advanced trader, you might even want to keep an eye out for brokers that offer minors and exotics to trade. These pairs have much less liquidity and higher spreads – but can often provide excellent opportunities for profits. Again, due to the volatile nature of these pairs, beginners should probably steer clear until they have more experience in the market. The section above highlights a selection of the best Canadian forex brokers this year. To help streamline your decision making, the table below presents a breakdown of the critical factors relating to each broker – providing a handy way to compare and contrast fees, spreads, and leverage.

- For instance, a trader may invest $1,000 in cash, and borrow a further $9,000, in order to trade with $10,000.

- The broker’s fixed spread is more comprehensive when compared with standard spreads and does not have any commissions involved.

- The forex markets are prone to market volatility; there are frequent variations in the exchange rates which involves a high risk of losing money which is a significant disadvantage.

- The Ontario Securities Commission – called also with the short OSC –is, on the other side, an independent Forex trading regulation agency that works in the Ontario legislation region.

This activity is done through a specialized broker that offers the opportunity to trade currencies instantly using a trading platform connected to the interbank market in real time. Choosing one of the best forex brokers in Canada with a solid range of assets is another way to optimise your forex trading. There are hundreds of forex pairs in the worldwide FX market – so ensuring the broker you choose offers a variety of them to trade will mean that you’ll always have access to market opportunities. As you can see from the list above, there are numerous forex brokers to choose from, each having its own unique selling point and fee structure.

Are the profits I make on forex taxable in Canada?

These three offer a safe and optimal trading environment for Canada-based forex traders. However, if you’re looking to start trading right away, we’d recommend opening an account with Avatrade. By signing up with Avatrade, you’ll be able to get up and running in under ten minutes, with minimum deposits of only $100. Aside from that, Avatrade allow you to trade the forex market with 0% commissions – ensuring you’re able to save substantial amounts of money in the long run. As this guide has highlighted, there are many brokers to choose from for Canada-based traders – many of which offer a trustworthy and cost-effective trading environment.

If you’re looking to sell your home quickly and effortlessly, selling it as-is to a trusted home buying company like https://www.buymyhouse7.com/alabama/ can be a smart choice. You won’t have to worry about remodeling or making repairs, and you can get a fair offer for your home.

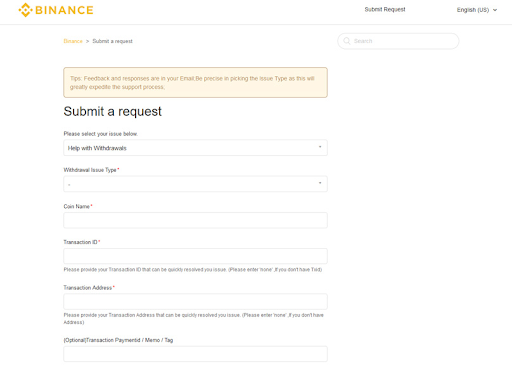

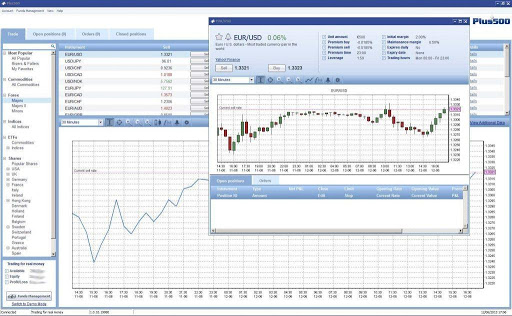

You can visit IIROC’s website directly where it will list which Forex brokers in Canada they cover – this is the best way to verify that the information provided by the Forex broker in Canada is correct. If you are unsure how brokerage fees work, check out this article on the various fees, charges and costs. It is clear from the above mentioned rules that Canada has quite strict regulatory procedures. For example the maximum available leverage which varies from currency to currency is higher for major currencies and lower for more exotic or minor currencies. Each individual investor entering the Forex market must possess a minimum income, financial assets or to have a minimum net worth as specified by the regional or provincial governing body. The first section that says ‘Our Trading Platforms’ represents forex.com’s proprietary platforms.

These two entities provide excellent protection for forex traders – so if your chosen broker is covered by one of them, then you’re onto a winner. Interactive Brokers is popular because of the sheer variety of investment options it offers. Experienced traders can participate in global markets, trade Forex pairs, purchase options, and much more. On the other hand, because of the sophisticated nature of IBKR’s platform, it can feel somewhat intimidating for new investors.

Comparison of Best Brokers in Canada

You can trade Forex in Canada the same way as in the rest of the world. For example, if you want to make sure you have the best Forex trading platform, you will find that the best currency trading platform in Canada will be as good as anywhere else in the world. Once you have chosen the best Forex broker to meet your needs, you can choose the best Forex trading platform and the account type that is suitable for your trading. A micro lot is 1,000 units of a base currency, or a hundredth the size of a standard lot.

It’s worth noting that the regulations may be different from province to province within Canada itself. The classic “buy low, sell high” trading strategy, swing or momentum trading involves entering and exiting the market based on momentum technical indicators. This strategy limits all transactions to a single trading session. Day traders will enter and exit positions intraday but close out all positions by the end of the trading session to avoid the extra risk involved in taking overnight positions. This strategy takes advantage of the extreme volatility exhibited by currency pairs after the release of important economic or geopolitical news.

IIROC regulated brokers do provide an extra sense of security while trading the Forex markets with a huge amount of capital. The CIPF program that offers protection for up to $1 million as the protected trading capital is certainly one of the best guarantees provided by any regulatory organization in the world. Even the FCA of UK limits the amount of compensation to just around $50,000, which makes it hugely attractive for traders to count on their brokers to honor their agreement with their clients. IIROC imposes several restrictions on trading, which further requires Forex brokers in Canada to adhere to several conditions to be able to receive an IIROC license. The option of trading with any broker of choice is another privilege enjoyed by Canadian investors; however, some rules prevent traders from investing in non-regulated brokers.

Trade CFD futures on a range of global indices, agricultural commodities, and Energies. Hundreds of public companies from the US, UK, France & Germany available to trade. At FxPro, we are constantly developing and adding new products to meet our traders’ needs and have expanded our product offering to include popular new US Share CFDs. The IIROC was a relatively great regulatory organization up until their recent regulation changes.

Fees

In an attempt to explain legal Canadian Forex trading in more detail, we will list the answers to the ten most frequently asked questions on the topic. While MetaTrader is a third-party software, all the other platforms have been built and maintained by AvaTrade. Needs to review the security of your connection before proceeding. There still are many Forex brokers that accept residents of Canada.

As far as trading fees go, Saxo Bank is quite competitive – with an average spread of 0.8 pips for the classic account. To make that even more appealing, the brokerage focuses on spread-only pricing – all traders, regardless of account types, will pay $0 in commission fees. If that sounds appealing to you, take a look at our in-depth review of Interactive Brokers. The Foreign Exchange Market is where traders exchange currency pairs 24 hours, 5 days a week. It’s the most liquid, and largest over-the-counter market, offering access to traders all over the globe, no matter where you are.

The IIROC is a self-regulatory organization that oversees all investment dealers and trading activity on debt and equity marketplaces in Canada. It has the authority to set rules and regulations for its members, which includes financial, supervisory, and sales practice requirements, as well as rules related to the handling of customer complaints. In addition, the IIROC has the power to discipline and fine its members for any violations of its rules. Forex trading, also known as foreign exchange trading, is the process of buying and selling different currencies in order to make a profit.

What is the IIROC?

The low trading fees offered by these online brokers are highly competitive spreads and straightforward. It does not offer a deposit bonus when the user signs up with their platform. The user should constantly check the official website to see if there are any changes in the roll-over rates or financing charges. CMC Markets review to learn more about this online platform, its financial services, and its features that benefit Canadian traders.

Brokers offer multiple platforms designed for different experience levels. While basic trading platforms require a low minimum account balance, advanced platforms will allow for reduced pricing for high-volume traders. When choosing the best Canadian forex brokers, consider the transaction costs when you trade currency pairs , and one also gets Canadian securities administrators’ support. If you are interested in Islamic account trade, check the platform support, which also may include support for the US dollar. These actions are also subject to the notice of the Canada revenue agency, which monitors top forex brokers in Canada and regulated brokers, as they act at their discretion.

For instance, a trader may invest $1,000 in cash, and borrow a further $9,000, in order to trade with $10,000. Margin rates and fees are also important to pay attention to if you plan to trade using leverage. By choosing brokers that are policed by regulators, investors can ensure that they are using a trustworthy firm. Before you start trading Forex, you should be aware of the risks involved. The trading that takes place on the Foreign Exchange Market is what actually sets the prices for each currency. Prices can be affected by global events, expectations of inflation, and more.

So, by following the steps below, you’ll be able to be set up and ready to go with Avatrade in under ten minutes. One excellent feature FXCM offer https://broker-review.org/ is their Active Trader discount. If you are active in the market, FXCM will allow you to claim back some of the money you spend on spreads.

List of Forex Broker That Accept Canadians

Canada is somewhat limited in the number of forex brokers that can be used relative to other areas of the globe like the U.K. When you are deciding what type of account you want, the biggest factor will often be the amount of money you have available to deposit with your Forex broker in Canada. Micro accounts and mini accounts will normally require a smaller deposit than a standard account.

These products may not be suitable for everyone and you should ensure that you understand the risks involved. Commodities including gold, silver, platinum, crude oil, and other energy commodities are offered for trading as CFDs. It is strongly advised to use a licensed and regulated broker to minimize risk.

You can also do something similar with the National Registration Search tool available on the CSA website. Even though it is quite difficult to regulate the fast paced Forex market, there are quite a few governmental and non-governmental agencies around the world which regulate the flow of capital in the Forex market. Canadian traders can safely trade through and forex and CFD broker that is licensed by the IIROC. CFD trading is legal in Canada, so there shouldn’t be any issues.